Are you a D2C brand suddenly struggling with rising digital advertising costs? Let Stage 1 Help you Build a Path to Profitability

What is Happening with Direct-to-Consumer Brands?

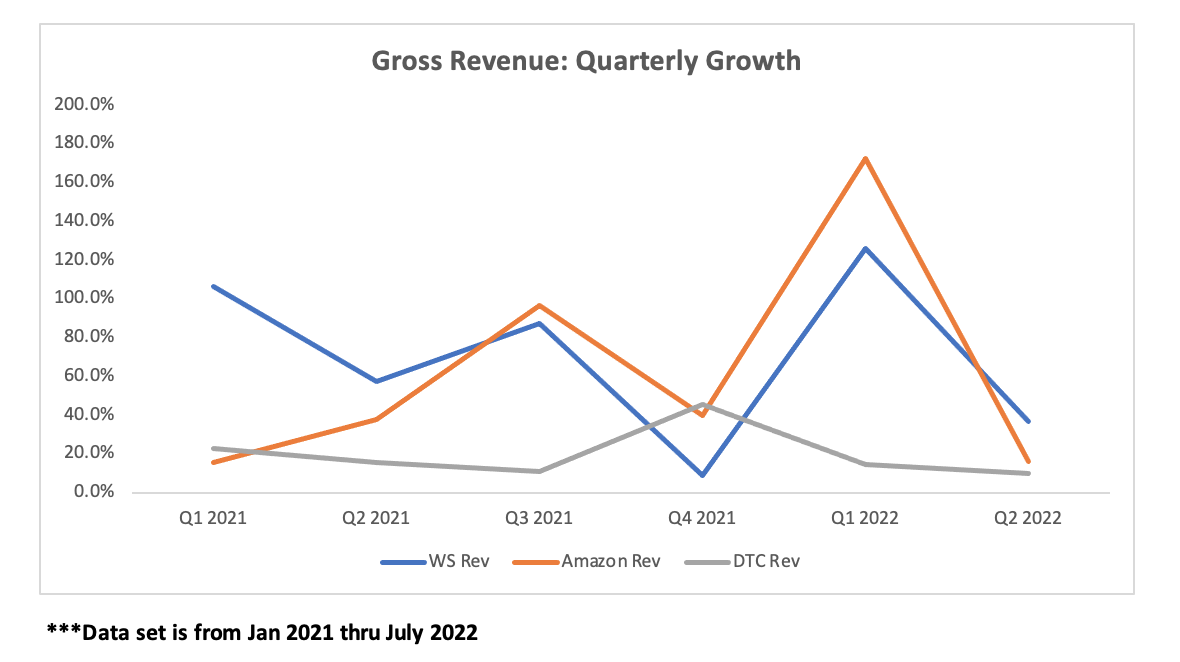

Many direct to consumer (D2C) brands have been struggling for the last 18 months as marketing channels have become less effective and costs have increased. Our studies show that it takes more than double the advertising spend to get the same results as this time last year.

Immediate actions

These are the immediate changes you can make to address and mitigate these challenges:

- Rethink your marketing strategy:

- Drastically pull back on digital advertising which includes tactics like paid social, paid search, and banner ads

- Shift those dollars to building your online community and increasing brand awareness

- The time is now to move away from paid social and paid search and look to build a holistic approach to building awareness and driving traffic

- Build an omni-channel strategy by shifting online ad dollars to in-store selling and marketing initiatives (education, sampling) to drive customer trials of your product

- Focus on creating repeat customers (retention marketing) vs getting new customers because it can cost up to five times more to get the new customer (Subscriptions, loyalty programs and memberships are good customer retention strategies, when done correctly)

- Reforecast your business for the changing market conditions to see the impact to cash and your P&L (you may become more profitable)

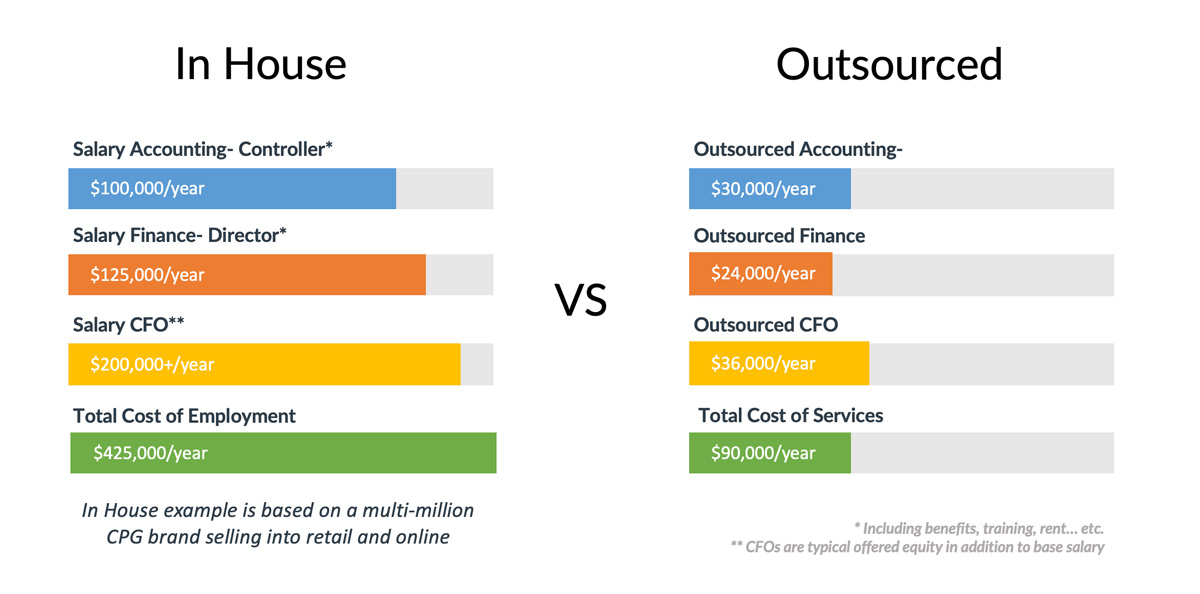

- Outsource tasks that can be done more efficiently by an agency and save you recourses

- Closely track marketing spend and make strategic decisions based on maximizing ROI

- Amazon may be a good online vehicle; just be aware of the costs that go into the Amazon channel before committing to that strategy (agencies can be very helpful in setting up a thriving and profitable Amazon business)

How Stage 1 can help

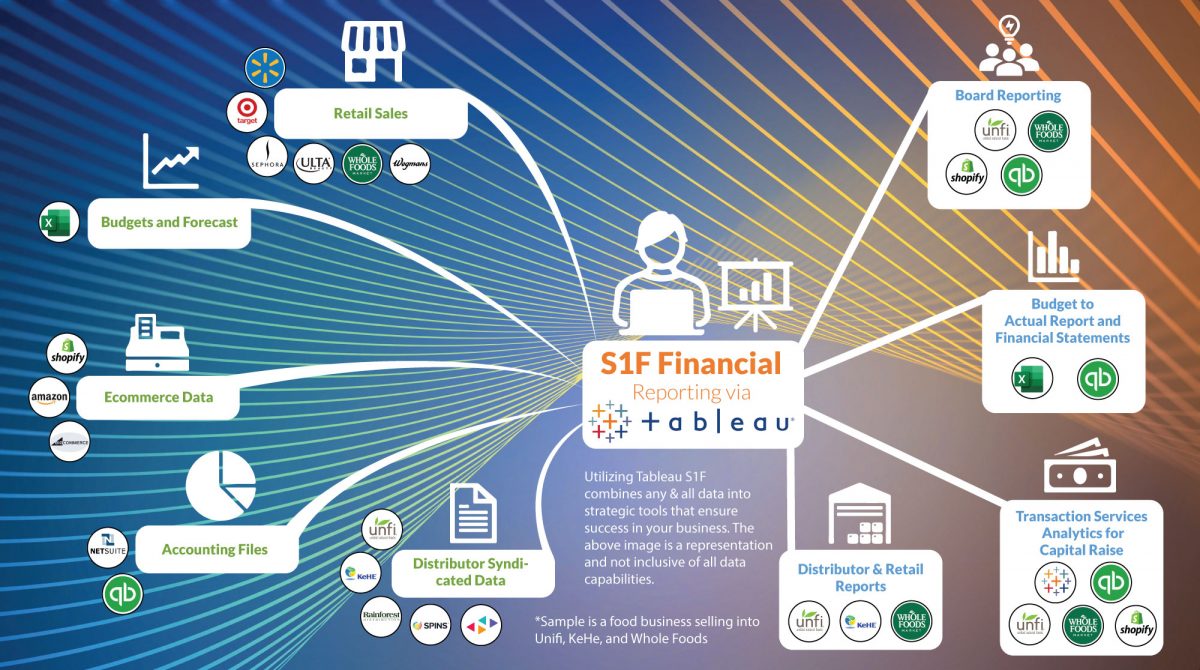

We’re assisting D2C companies with tools such as:

- Unit economics analysis of your SKUs and consumer trends – This can help to understand what SKU’s may need to be discontinued

- P&Ls by channel

- Detailed weekly cash forecasting

- 2023 Budget refreshes to represent the current market dynamics

- Support with financing options (Line of Credit)

- CFO insights into comparable company metrics

If you would like to learn more, our CEO, Katy Triefenbach, would be more than happy to connect with you. Feel free to book a time using this link: Book your introduction meeting