Introducing the California Department of Tax and Fee Administration Sales Tax Law and Why It is so Complicated.

California sales tax laws are complex, intimidating, and often confusing for business owners. With over 400 sales tax jurisdictions in the state of California alone, sales taxes can be a headache to understand and comply with. This article will provide an overview of the basic key points that all companies doing business in California should be aware of when dealing with sales taxes.

We’ll cover topics such as different sales tax rates and exemptions, compliance requirements from both state and local governments, tips for streamlining operations to maximize savings by tracking exemptions and deductions, as well as real-life examples of companies that have successfully navigated sales taxes in California, including Tesla and Box. Finally, we’ll also provide resources on where to keep abreast of changes regarding sales taxes in the state (e.g., CDTFA).

By understanding this information, you can avoid costly compliance mistakes!

Statistics on the Number of California Sales Tax Jurisdictions

The sales tax landscape in California is complex and ever-changing. The state has over 400 sales tax jurisdictions, making it difficult for businesses to keep up with all the different rates and exemptions that apply to them. Each jurisdiction may have its own sales tax rate as well as specific exemptions or deductions that must be considered when filing sales taxes.

In addition, some cities and counties also impose their own sales taxes, which can further complicate matters. For example, Los Angeles County alone has nearly 100 distinct sales tax jurisdictions! This means companies doing business in California must be aware of multiple sales tax rates and rules depending on where they are selling products or services. California has around 1,200 local jurisdictions, with the smallest one being the city of Industry, covering an area of just 12 square miles.

It’s important for businesses conducting business in California to understand the various sales taxes applicable to them so they can accurately file returns and avoid costly compliance mistakes. Knowing how many jurisdictions exist is a good first step toward understanding this complicated law!

In some cases, businesses have faced significant penalties for non-compliance with California’s sales tax laws. For instance, in 2019, the CDTFA announced that a Southern California auto dealership was assessed over $7 million in sales tax, interest, and penalties due to the underreporting of sales and improper exemptions. This serves as a reminder of the importance of staying compliant with sales tax regulations.

Overview of the Different Sales Tax Rates and Exemptions in California

Sales tax is generally a destination-based tax, meaning that the sales tax rate applied to a transaction will depend on where the product or service is being sold. The California Department of Tax and Fee Administration (CDTFA) sets sales tax rates for all taxable products and services in California.

The state sales tax rate for most items is 7.25%, but there are many exceptions. For example, some counties may impose additional sales taxes, which means certain transactions may be subject to higher sales taxes than normal. Additionally, certain items such as food, medical supplies, and clothing can be exempt from sales taxes in some jurisdictions while still being taxable in others. It’s important to check with local authorities when filing sales tax returns in California to make sure you’re correctly applying sales taxes and exemptions.

Key Compliance Requirements for Businesses Conducting Business in California

When doing business in California, it is important to understand the sales tax compliance requirements. Companies must keep detailed sales and use tax records, including sales invoices and sales receipts. Businesses should also be aware of any sales taxes that apply to their products or services. It is also important for companies to register for sales tax with the California Department of Tax and Fee Administration (CDTFA) as well as any local sales taxes applicable to their business.

Businesses must file sales tax returns on a regular basis to stay compliant. The filing frequency varies from jurisdiction to jurisdiction, so companies should check with the CDTFA or with local authorities when preparing sales tax returns. Failing to file timely sales tax returns can lead to penalties and interest charges, so businesses must ensure they are meeting all filing deadlines in a timely manner.

According to the CDTFA, in the 2019-2020 fiscal year, over $37 billion in sales tax revenue was collected, highlighting the importance of compliance for businesses operating in California. In another real-life example, a Southern California-based online retailer faced over $2 million in back taxes, penalties, and interest due to non-compliance with California sales tax regulations.

Tips for Streamlining Operations to Maximize Savings by Tracking Exemptions and Deductions

When conducting business in California, it is important to be aware of sales tax exemptions and deductions that may reduce your overall liability. Keeping track of these exemptions can help reduce the amount of taxes owed and ultimately save money for your business. Additionally, businesses should consider software solutions that automate sales tax reporting and filing processes to save time and resources when preparing sales tax returns. Finally, staying abreast of any changes or updates to sales tax laws can help you stay compliant with all applicable regulations while maximizing savings from tracking exemptions and deductions.

Real-Life Examples of Companies that Have Successfully Navigated Sales Taxes in California

Tesla and Box are two examples of companies that have successfully navigated sales taxes in California. Tesla, the electric vehicle manufacturer, effectively tracked and applied exemptions for manufacturing equipment purchases, which led to significant savings in sales tax liabilities. This highlights the importance of understanding and applying relevant exemptions to reduce tax burdens.

Box, a cloud content management and file sharing service, has also successfully navigated California’s sales tax landscape. By staying up to date with changing sales tax regulations and leveraging technology to streamline sales tax processes, Box has managed to remain compliant with California sales tax laws while continuing to grow its business.

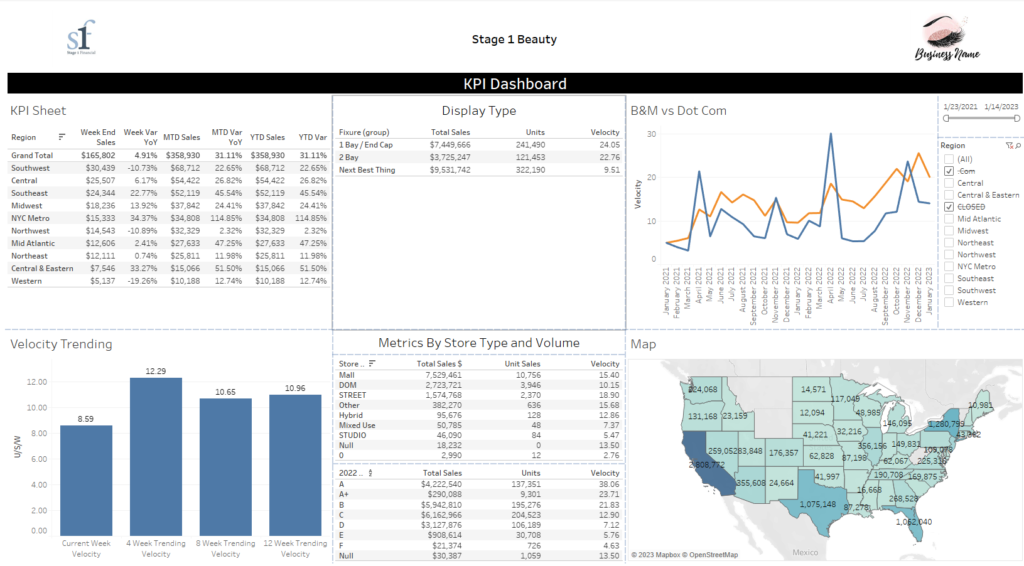

Why You Need Stage 1 Financial to Help You Stay on the Right Track to Compliance in CA and Other Jurisdictions in the U.S.

California’s sales tax laws are notoriously complicated, and trying to navigate them on your own can be a risky endeavor. Stage 1 Financial is here to help your business stay on the right track to compliance in California and other jurisdictions in the U.S. Our team of experts has the knowledge and experience necessary to ensure that your sales tax compliance is in good hands.

By partnering with Stage 1 Financial, you can trust that your sales tax compliance is being handled by professionals who understand the complexities of California’s sales tax laws. We’ll help you identify and track applicable exemptions and deductions, stay up-to-date with changes in sales tax regulations, and ensure your business remains compliant and on track for success.

Don’t leave your business’s sales tax compliance to chance—let Stage 1 Financial’s expertise work for you! With our guidance and support, you can focus on growing and expanding your business, knowing that your sales tax compliance is being managed by a team of skilled professionals.

Resources to Keep Abreast of Changes to Sales Tax Laws in the State (e.g., CDTFA)

To stay informed about changes to sales tax laws in California, businesses can consult the following resources:

- California Department of Tax and Fee Administration (CDTFA): Visit the CDTFA website (https://www.cdtfa.ca.gov) for comprehensive information on California sales tax laws, regulations, and updates. You can also sign up for email updates on specific topics, such as sales tax rate changes.

- Local Government Websites: Check the websites of city or county governments where your business operates for information on local sales tax rates, exemptions, and compliance requirements.

- Tax Advisory Services: Consider engaging Stage 1 Financial, who specialize in California sales tax laws, to help you navigate the complex regulations and stay up-to-date on changes.

- Tax Automation Software Providers: If you use tax automation software, the provider may offer updates or notifications when there are changes to sales tax laws that impact your business. Check with your software provider for available resources.

- Professional Associations and Business Organizations: Joining industry-specific associations or business organizations can help you network with other professionals who face similar sales tax challenges. These groups may offer webinars, newsletters, or forums where members can discuss changes to sales tax laws and share best practices for compliance.

By utilizing these resources and enlisting the help of Stage 1 Financial, businesses can stay informed on changes to sales tax laws and ensure that they remain compliant with all applicable regulations. Don’t leave your sales tax compliance to chance—trust Stage 1 Financial to guide you through the complexities of California’s sales tax laws and keep your business on the right track.

Written by

Laurie Brooks

A SALT Staff Accountant at Stage 1 Financial