Good accounting alone will not protect your business, but great forecasting might.

With concerns escalating around COVID-19 (Coronavirus), our team at Stage 1 Financial wanted to address the potential impact of the virus on your companies, vendors, and customers. Our team of experts has identified a number of critical steps to help your company thrive in this unforeseen business climate.

To develop a more in–depth understanding as to the impact this might have on your company, please reach out to schedule a meeting with one of our CFOs to talk about this topic in more detail. We’re here to support you!

Step 1: Understand The Changes Happening In The Business Environment

Supply Chain: Supply from overseas manufacturers is likely to be disrupted. Many companies are already feeling the effects, especially those purchasing foreign-sourced input materials such as bottles and corrugate. For those of you lucky enough not to feel that sense of panic yet, put on your critical thinking hat – there may be some element of your supply chain that could be impacted in the coming months. The time is now to ensure you are thinking through contingency plans, including increasing safety stock levels and starting to engage with alternative suppliers.

Those in the fashion and apparel industries will probably be hit the hardest in the months to come, given the traditional two-season model with long lead times. Supplies may last the quarter but dwindle for the next seasonal release. This means plans need to be made now, allowing you to respond proactively, instead of reacting out of desperation.

Demand and supply planning will be one of the most important tools to help you through this time of uncertainty. Ensure your brand knows its next 3, 6 and 12 months demand forecast, allowing your operations team to properly plan for the purchasing of key raw materials and finished goods, including appropriate lead times to make necessary adjustments. In addition, maintain direct and constant communication with all your partners in your supply chain to ensure you are fully informed on timing and changes.

Consumers and Customers: Based on consumer reaction to the SARS outbreak in 2003, consumers tend to halt all non-essential purchases when they are fearful about the spread of a virus. According to a flash survey from the CNBC Global CFO Council, demand from Chinese consumers decreased by 20% shortly after the outbreak. This pattern is projected to continue on a global scale as the virus spreads.

Consumers are also expected to rely heavily on delivery type purchasing patterns (i.e. DTC, Amazon, Instacart) to avoid going into public locations for fear of exposure. This will greatly affect those with brick and mortar locations, those in the service industries and certain retailers where your products are sold. As the Covid-19 virus will likely affect sales across all industries, it is vital to revise all 2020 projections.

That said, you may find unique opportunities during this time of disruption. For example, Costco, Target and Walmart have seen a significant increase in foot traffic in the past few weeks, creating more opportunities for higher trial from these accounts. Further, there are certain beauty subscription boxes that may have a shortage of products from their partner brands which creates opportunity for the brands who can supply these customers.

Closely watch the changing behaviors of consumers and customers, including both the risks and opportunities this may present. Again, communication is key – talk to your consumers often and directly, and engage regularly with the buyers at your retailers so that they partner with you on win-win sales and marketing initiatives.

Step 2: Raise Money!

Companies may struggle to find financial support as lenders are already changing their credit standards and some investors may become more reluctant to invest during this time of uncertainty. Other risk-taking investors might become more active, which is another example of a potential opportunity. For those companies seeking fundraising, you must be pitching your A-game. If you can’t confidently say “This is the best pitch deck we can produce,” it’s not good enough or if your financial model does not answer all of the questions investors and lenders are asking, it’s a good time to talk to one of our CFOs for insights into this process. Their expert advice can be the difference between being properly capitalized or not during this turbulent period of the business cycle.

The key is raising capital when you are already capitalized. If you have just raised a round of equity, it’s time to secure working capital financing to extend your runway. If you are in a lending process, it’s more than likely best to supplement debt with some additional equity. The smart balance of debt and equity will ensure you have a “war chest” to battle through the next 6 to 12 months.

Additionally, give yourself more time to raise capital. If you’re thinking about raising capital in the next 6 to 12 months, we recommend starting the process NOW! Give yourself plenty of time to work through the investment cycle.

Step 3: Continually Re-Forecast & Respond – The Changing Environment Can Accelerate Be Prepared

Covid-19 has kicked off an unpredictable windstorm of uncertainty, quickly changing the financial environment and sending your projections from three months ago right out the window. With a near pandemic on our hands, companies need to continually review their financials and respond accordingly. While we entrepreneurs love to plan for the long–term, right now, we need to focus on the months just ahead and be ready to respond accordingly.

To ensure you are prepared, we recommend the following planning tools and processes are in place and operating effectively:

-

- Track sell–through, as changes in consumer behavior can be identified earlier by watching weekly and monthly buying behaviors

- Update revenue forecasts with any changes in sell–through patterns, helping understand where sales are trending

- Reforecast the overall business monthly, ensuring you don’t keep leaning in on spend when you may be in a period of slowing growth

This means staying on top of the changes in spending and consumer habits monthly. All smart business decisions are based on analytics, not assumptions. Panicking will help nothing, while preparing makes all the difference.

Step 4: Tighten Spending! This Is The Time To Review Expenses and Determine Opportunities For Cost Savings

It’s critical to review expenses to ensure your operations are optimized and non-essential spending is minimized to preserve liquidity. Take a fresh look at your operations including:

-

- Categorize expenses by fixed (e.g. rent) and variable (e.g. raw materials) and understand which fixed costs may need to be reduced in the event of a decrease in consumer demand. Keep in mind that to pay for Fixed Costs requires a minimum amount of monthly sales, and that any decrease here reduces that pressure while increasing margin.

- Confirm your understanding of the Return On Investment (ROI) of promotional and marketing spending and align spending levels with forecasted changes in revenue.

- Optimize Cost of Goods Sold (COGS) by reviewing and benchmarking the pricing of input items (e.g. raw materials), labor, overhead, 3rd party manufacturing, and supplier pricing (e.g. payment terms and tier pricing).

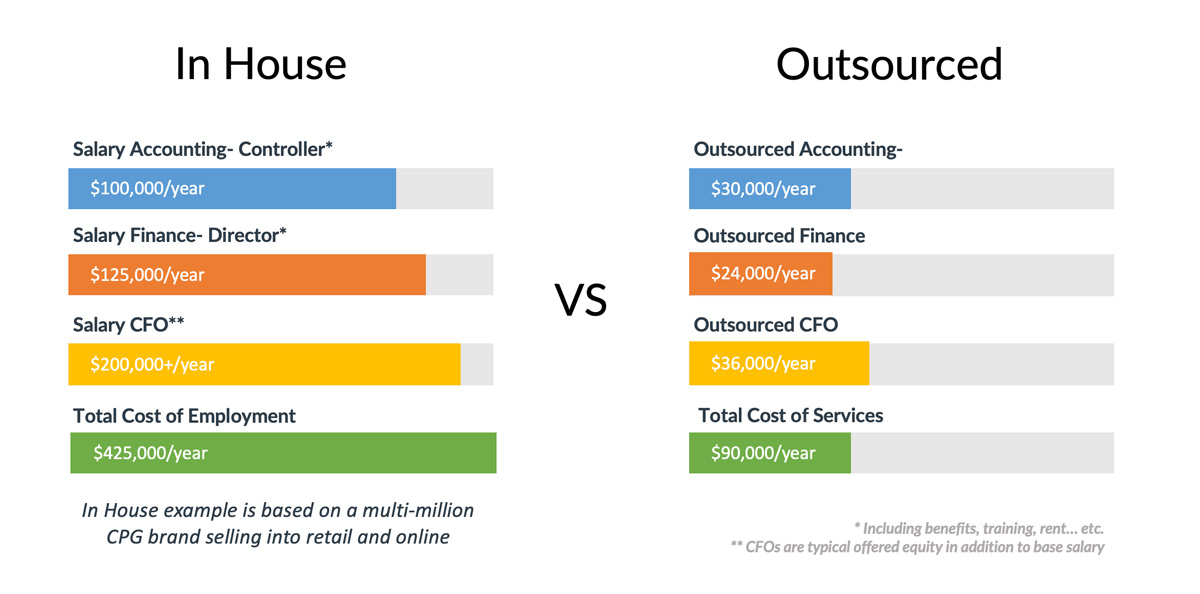

Our CFOs and Finance team can help you in analyzing your cost base to determine opportunities for improvement and support you in the process of renegotiating contracts with key vendors and suppliers.

Step 5: Look for Help Everywhere! Government, Organizations…

On March 5th the federal government passed the coronavirus funding bill, which included relief to small businesses, including $1 billion in loans for companies impacted by the virus. The current discussion includes additional relief through cuts in payroll taxes, small business incentives and support to hourly workers who become sick from the virus. As the business environment continues to change, watch for potential support provided by local, state and federal governments.

There may be programs from your vendors, customers and non-profit organizations that support small businesses.

Stage 1 Financial will continue to provide more information as it comes available, please share any information and we’ll be sure to disseminate.