Tough economic times ahead? 3 steps to prepare

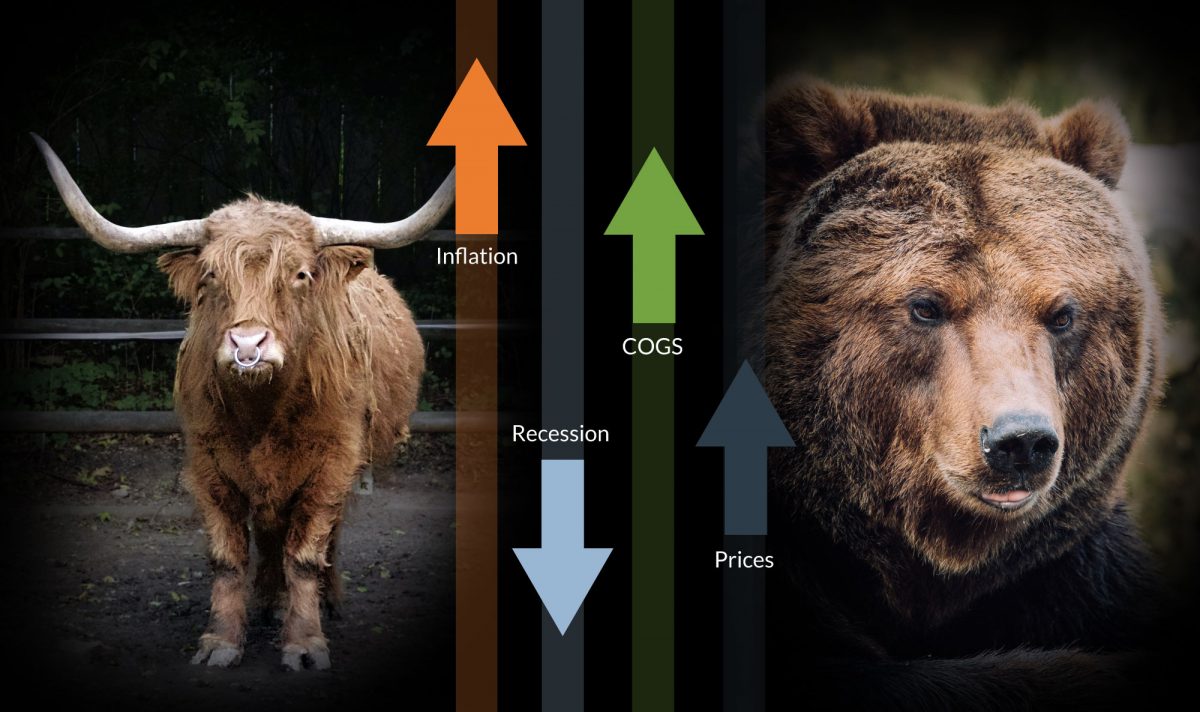

With concerns escalating around a possible recession coming, our team at Stage 1 Financial wants to address the potential impact on your companies, vendors, and customers. Our team of experts has identified 3 critical steps to help your company thrive in this potentially difficult business climate.

To develop a more in-depth understanding of the impact this might have on your company, please reach out to schedule a meeting with one of our CFOs to talk about this topic in more detail. We’re here to support you!

Step 1: Cash is King! Start Conserving Cash

It’s critical to review expenses to ensure your operations are optimized and non-essential spending is minimized to preserve liquidity. Take a fresh look at your operations including:

-

- Right size expenses – Forgo expensive in-house hires when you can outsource expertise at a fraction of the cost.

- Lower Fixed Expenses – Categorize expenses by fixed (e.g. rent) and variable (e.g. raw materials) and understand which fixed costs may need to be reduced in the event of a decrease in consumer demand. Keep in mind that paying for fixed costs requires a minimum amount of monthly sales and that any decrease here reduces that pressure while increasing cash flow.

- Ensure Marketing Cost Generates Cash – Confirm your understanding of the Return on Investment (ROI) of marketing spending and align spending levels with forecasted changes in revenue.

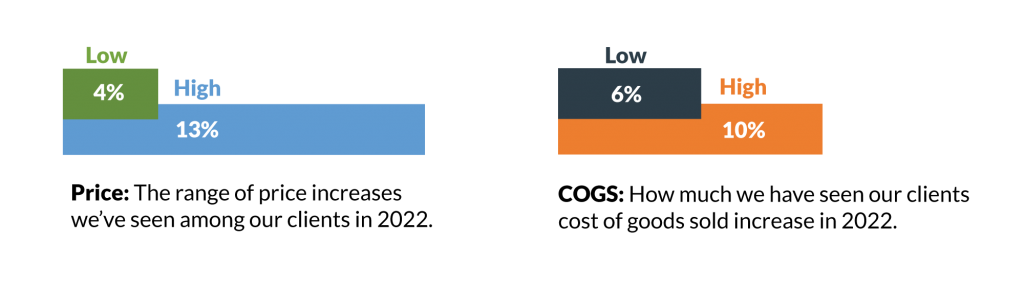

- Optimize Cost of Goods Sold (COGS) – Reviewing and benchmarking the pricing of input items (e.g. raw materials), labor, overhead, 3rd party manufacturing, and supplier pricing (e.g. payment terms and tier pricing).

- Leverage Working Capital – Collect A/R faster! Reduce inventory by running more frequently (even at higher costs) and work with vendors to the right size terms.

Our CFOs and Finance team can help you in analyzing your cost base to determine opportunities for improvement and support you in the process of renegotiating contracts with key vendors and suppliers.

Step 2: Adjust Expectations for Raising Capital and Start the Process Early!

Companies may struggle to find financial support as interest rates continue to rise and total capital being invested shrinks. For those companies considering fundraising, there are a few key tips:

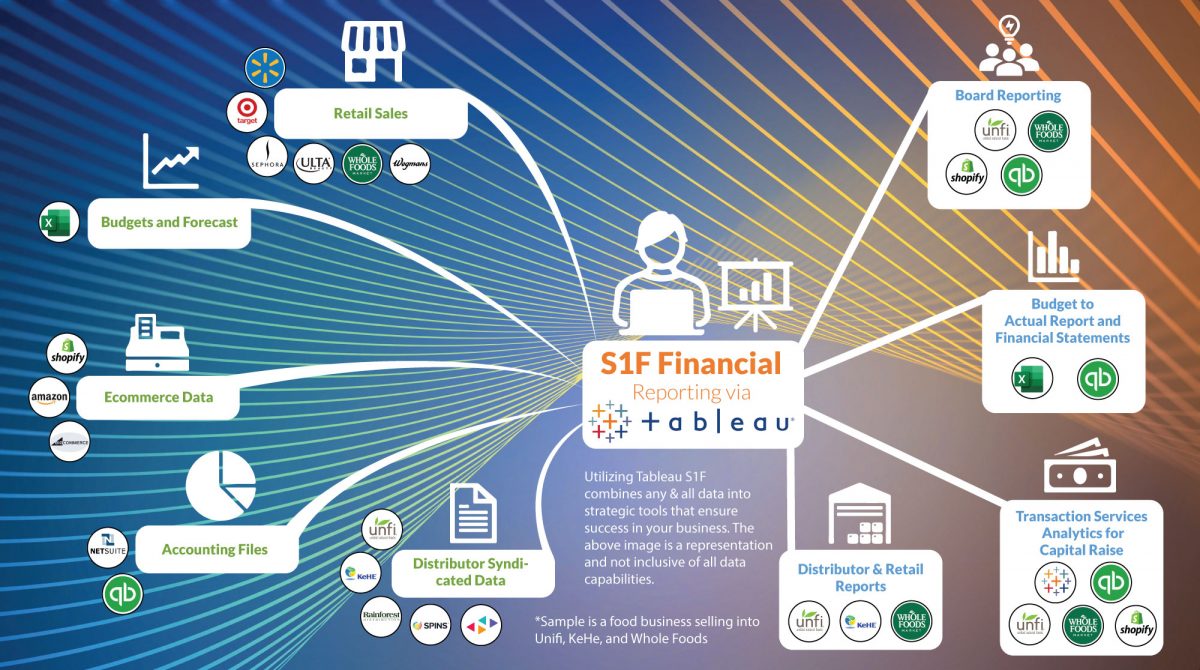

- You might only have 1 chance, don’t miss your shot – When pitching, bring your A-game. If you can’t confidently say “This is the best pitch deck we can produce,” or if your financial model does not answer all the questions investors and lenders are asking, it’s a good time to talk to our transaction services team. Their expert advice can be the difference between being properly capitalized or not during this turbulent period of the business cycle.

- Start raising before you need it – Give yourself more time to raise capital. If you’re thinking about raising capital in the next 6 to 18 months, we recommend starting the process NOW! A typical process takes 6 months, plan for 9 – 12 months in this environment.

- Back up planning – Have as many levers to pull as possible, agree on a plan with existing investors and leverage the debt options. Also, try to figure out a scenario to get to cash flow break-even (or close to it). Raising will take time, give yourself as many options as possible.

Step 3: Continually Re-Forecast

Your place in this shifting economic world can change quickly. With the possibility of a recession on our hands, companies need to continually review their financials and respond accordingly. While we entrepreneurs love to plan for the long-term, right now, we need to focus on the months just ahead and be ready to respond quickly. To ensure you are prepared, we recommend the following planning tools and processes are in place and operating effectively:

-

- Great Sales Forecasting is Everything – Track sell-through, as changes in consumer behavior can be identified earlier by watching weekly and monthly buying behaviors

- Update frequently – Update revenue forecasts with any changes in sell-through patterns, helping understand where sales are trending

- Run Scenarios – Running a wide range of scenarios allows you to prepare for the worst and execute for the best. Understand how to work towards cash flow break-even, what levers you have to reduce burn short and long term, and what KPIs you need to be at to look attractive for raising capital

Our seasoned group of CFOs and Finance team can help you through these trying types, unfortunately, this is not our first rodeo in terms of managing downturns! Fortunately, we’re here to help you navigate these challenges.

Stage 1 Financial will continue to provide more information as it becomes available, please share any information and we’ll be sure to disseminate it.

In the meantime – reach out with any questions or concerns.

We’re here to support you!