Dallas, May 22, 2023/ — G.O.A.T. Fuel, the amazing new energy drink, has completed raising a $5 million Seed round of funding led by Stage 1 Fund. Stage 1 Fund is dedicated to strengthening consumer-driven brands like G.O.A.T. Fuel and it is Stage 1 Fund’s honor to be a part of this raise.

G.O.A.T. Fuel is co-founded by the NFL Legend & Hall of Famer Jerry Rice along with his daughter, CEO Jaqui Rice Gold, and his son-in-law, CMO Trevion J. Gold. Jerry Rice is considered by most NFL fans to be the Greatest Of All Time wide receiver. His drive for excellence continues off the football field and into the business arena. It’s why they call it G.O.A.T. Fuel.

G.O.A.T. Fuel was born from the lack of a healthy option in the energy and sports drink market. Jerry Rice decided he could find a better solution and that determination lead to the birth of G.O.A.T. Fuel. An energy drink crafted from the very mushrooms that Hymilain goats consume to get more oxygen to their bloodstream. He succeeded in bringing something better to beverage enthusiasts everywhere.

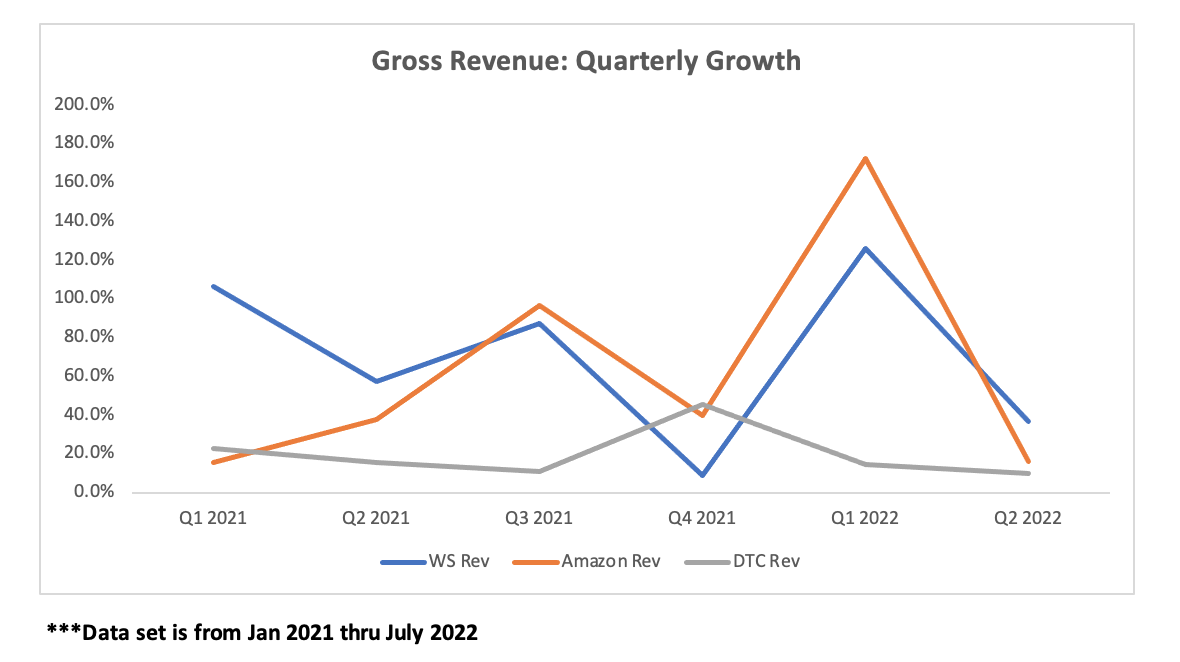

Stage 1 Fund’s partner David Bartholomew had this to say about G.O.A.T. Fuel’s deal, “Stage 1 Fund is pleased to announce our 2nd investment in the emerging beverage silo with our closing of G.O.A.T. Fuel. In particular, The U.S. energy drink market continues on an explosive path and is projected to be $30 Billion by 2027. G.O.A.T. Fuel has differentiated itself from the competition by formulating clean energy derived from plant-based adaptogens and has already demonstrated strong growth and velocities via a large distribution network. We are excited to be partnered with Co-Founders Jaqui Rice Gold & T.J. Gold, as well as the Greatest Of All Time, NFL Hall of Famer, Jerry Rice said Stage 1 Fund Managing Partner, David Bartholomew.”

Katy Triefenbach, CEO at Stage 1 Financial added, “Over the past several months Stage 1 Financial tracked a significant decrease in the amount of invested capital in the beverage silo. However, Stage 1 Fund saw a unique market opportunity for G.O.A.T. Fuel to take a leadership position in the growing segment of adaptogen Energy Drinks. Similar to what we saw in Lemon Perfect three years ago, G.O.A.T Fuel’s strong leadership team and unique flavor profile allow them to stand out among competitor brands entering the market. We are thrilled to partner with G.O.A.T. Fuel and project significant near-term achievements for the brand.”

This round of funding will be their first infusion of institutional growth capital and marks a significant shift in success for G.O.A.T. Fuel.

ABOUT G.O.A.T. Fuel

Greatest of All Time. The Energy Drink that Fuels Your Greatness. Tap into the Frequency. Tap into the Mindset. Tap into YOUR Greatness. No sugar, no preservatives, no aspartame, NO EXCUSES. To learn more about their brand or to find their products please visit Goatfuel.com.

ABOUT STAGE 1 FUND

Stage 1 Fund has built a robust and proprietary pipeline of deal flow through its affiliate Stage 1 Financial, which provides outsourced corporate services to consumer companies that are potential investment candidates. This unique and advantageous model applies quantitative and qualitative protocols via the core business of Stage 1 Financial, thereby heavily vetting potential investment opportunities prior to deploying capital. Stage 1 Fund is also focused on consumer brands that are driven by sustainability, environmental concerns, female and minority-founded companies. Learn more at stage1fund.com.

For more information, contact David Bartholomew – david@stage1fund.com

SOURCE Stage 1 Fund

Related Links

http://www.stage1financial.com