Weaving a long-term solution

How sales tax works

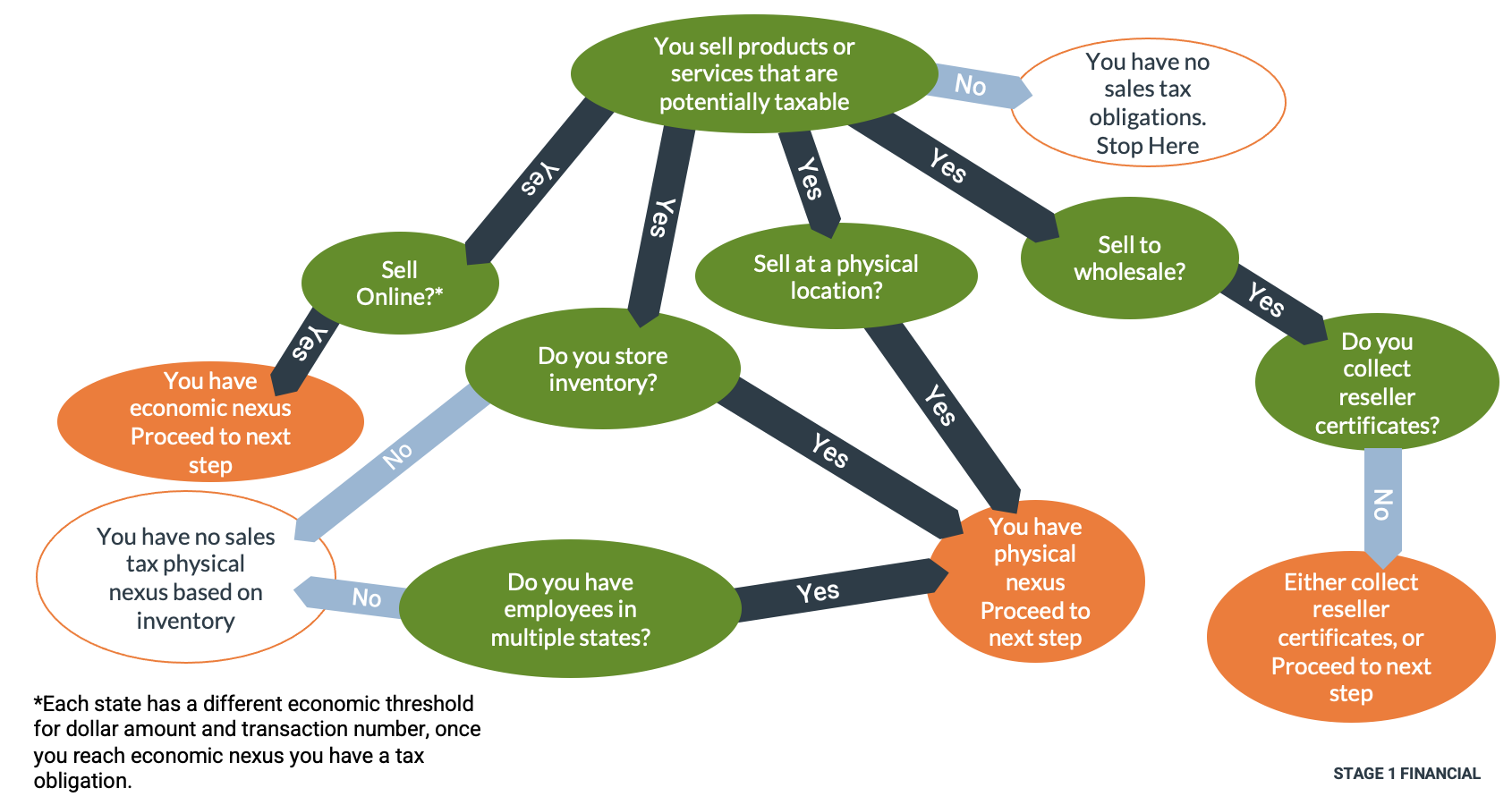

Generally, sales tax is imposed on all retailers that sell products and services to customers, regardless of whether it is sold online via e-commerce or from a physical brick and mortar store. States impose the sale tax at various rates depending on the specific product or service for sale. Fortunately, if you are compliant, the sales tax is collected from customers and remitted to the state at a state prescribed frequency (monthly, quarterly, or annually).

Becoming tax compliant

Sales tax compliance begins with recognizing what states you have physical and economic nexus with that create sales tax obligations. Once you have determined the states you have nexus, you must register in those states and create your sales tax account. At this point, the state will assign your filing frequency for your sales tax returns. If you reached nexus previously, we could discuss whether a Voluntary Disclosure Agreement fits your scenario better.

Step 1: Arrange a discovery call with Stage 1 Financial sales tax team

Who should arrange a meeting:

- Clients that sells tangible personal property or services

- A.K.A. you sell stuff to end-users

- You have exceeded $100k in sales

What to expect from the meeting:

- Introductions to Stage 1 Salt Team

- High-level discussion of current business status/ structure

- Review possible sales tax obligations (see next slide)

Step 2: Determining obligations on a discovery call

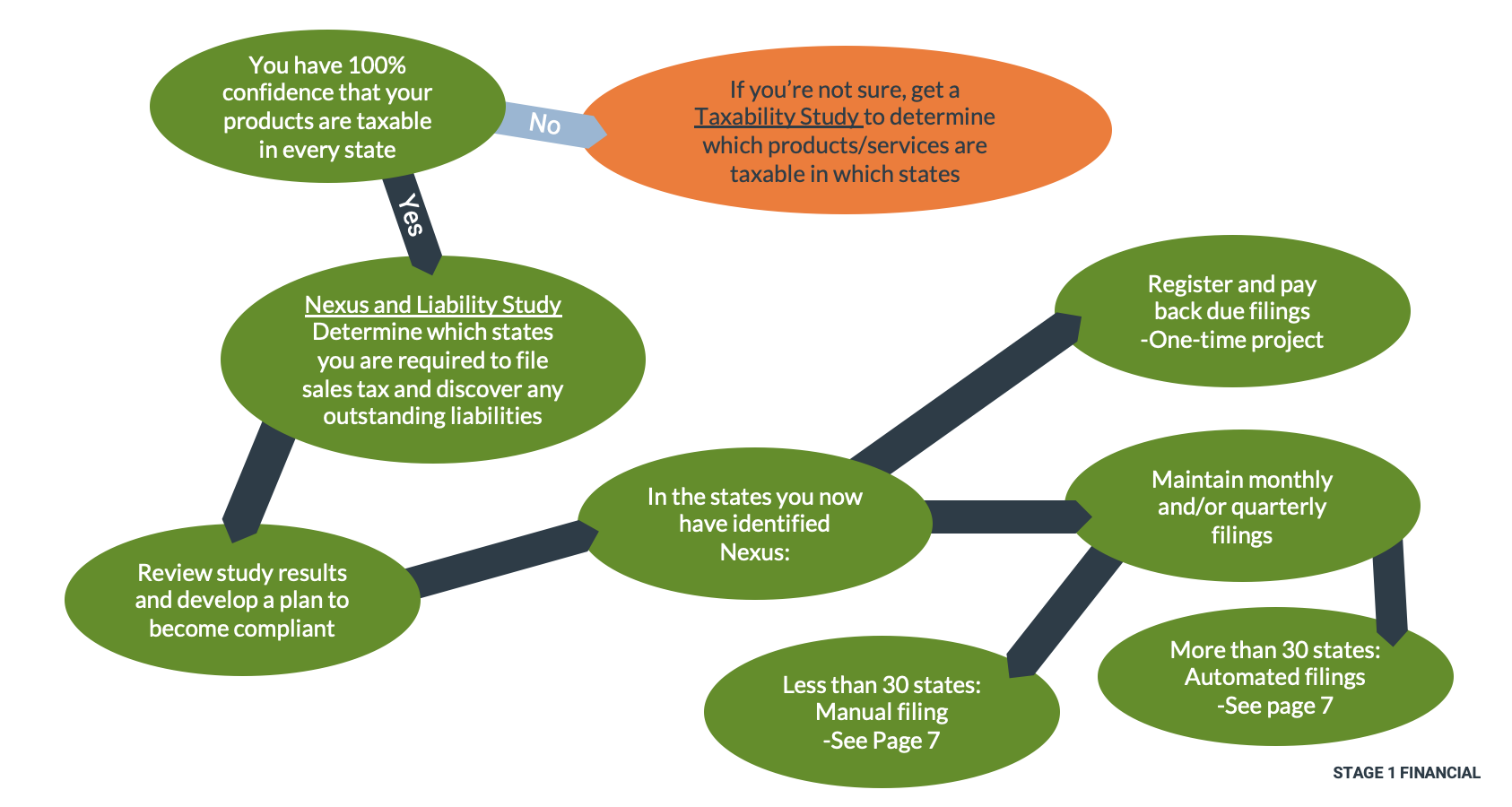

Step 3: Getting you compliant and ongoing management

Getting started

Nexus and Liability Report

Our Nexus and Liability Report will analyze your sales data, payroll, employee travel, inventory, and any third-party agreements for a set period and determine where your company has established sales tax nexus (physical, economic, or affiliate). Once we have determined the states you have sales tax obligations in, we will calculate the approximate outstanding sales tax liability for each state.

Taxability report

Our Taxability Report will provide in-depth analysis by state for each of your products and services and determine whether states impose sales tax on your products and services, and the proper tax rate to be imposed.

Filing systems

Manual filing

Our sales tax team will request your state portal and POS credentials and manage your sales tax filings manually. Manual filing entails pulling the raw sales data from the various POS systems, converting the raw data into data usable for the state, submitting an accurate return, and remitting proper payment to the state.

Automatic filing

Once you have grown and are manually filing sales tax returns in 20 or more states, we will connect you with tax software vendors that offer automatic filing and ensure that you only scope what is necessary while assisting you with all implementation or other ancillary services that can be provided internally, as well as providing monthly reconciliations.

A complete handoff

Sales Tax Management: A comprehensive solution

For clients that want minimal sales tax involvement but maximum compliance, Stage 1 offers Sales Tax Management. Here, we manage your company’s registrations, filings (manual or automatic), review your nexus, and hold a monthly call to update you on our findings and any next steps.

We’d love to meet you!

Want to boast about your growing company? Well, we want to hear it!